How to Build an Emergency Fund: A Complete Step-by-Step Guide

Building an emergency fund is the fastest way to create financial peace of mind. It shields you from surprise costs—medical bills, job loss, car repairs—without falling back on credit cards or high-interest loans. In this practical guide, you’ll define your target number, pick the right account, and follow a weekly plan that keeps savings growing automatically.

Why an Emergency Fund Changes Everything

Most financial stress isn’t about how much you earn—it’s about cash flow and timing. A well-funded emergency reserve prevents small problems from turning into expensive debt spirals. It also gives you options: negotiating a job offer from a position of strength, paying deductibles without panic, or choosing a better apartment without borrowing.

How Much Should You Save?

Start with $500–$1,000 as a “starter fund.” Then build toward 3–6 months of essential expenses. Your final target depends on stability and responsibilities:

- Stable job, single income: 3 months often works.

- Family or high fixed costs: 6 months gives safer runway.

- Freelance/variable income: 6–12 months reduces income risk.

Pick the Right Place to Keep It

The goal is liquidity and safety, not yields. Choose a high-yield savings account or money market account at an FDIC/NCUA-insured institution. Keep the fund separate from your checking so it isn’t spent by accident. Avoid locking it in CDs if early-withdrawal penalties would slow you down.

Step-by-Step Plan (30 Days to Momentum)

Week 1 — Set Your Target and Open the Account

- List essential monthly costs: rent, utilities, groceries, insurance, debt minimums, transport.

- Choose a starter target (e.g., $1,000) and a long-term target (e.g., 4 months of essentials).

- Open a separate high-yield savings account and nickname it “Emergency Fund.”

Week 2 — Automate Your First Transfer

- Schedule automatic transfers the day after payday so money moves before you see it.

- Start with a doable amount (e.g., $40–$75/week), then step up later.

Week 3 — Create Room in the Budget

- Audit subscriptions and pause anything non-essential for 60–90 days.

- Call providers (internet, phone, insurance) to request discounts or lower tiers.

- Meal-plan and shop with a list—small habits free up cash quickly.

Week 4 — Accelerate with Windfalls

- Send 100% of tax refunds, small bonuses, marketplace sales, or gifts to the fund.

- “Round-up” trick: if you planned to save $60, make it $75. The extra sticks.

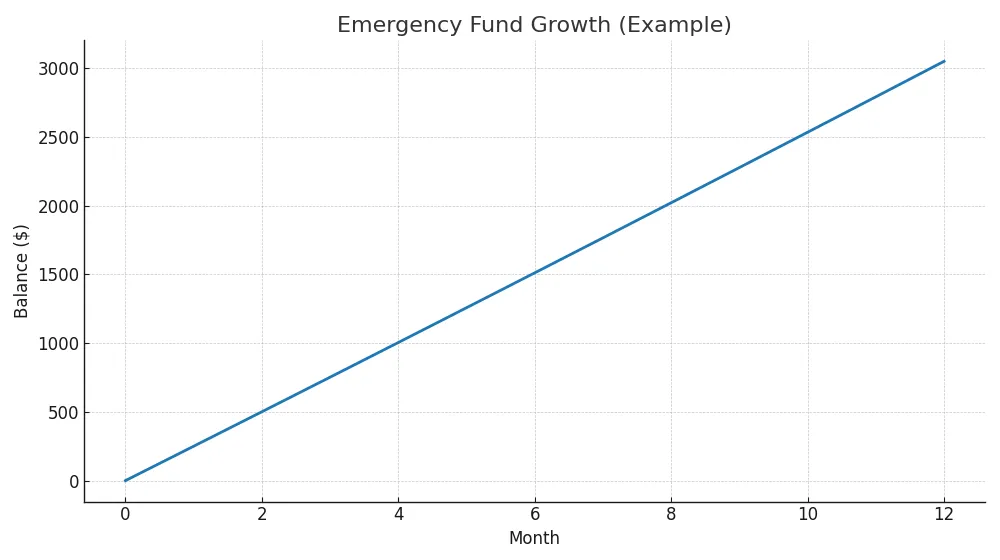

Example: 12-Month Savings Projection

Even modest weekly savings compound faster than most people expect. Below is a simple illustration assuming $250 monthly contributions and a small monthly interest factor.

Rules That Keep You Consistent

- Automate first: savings happens by default; spending is a choice.

- Use separate accounts: out of sight, out of mind.

- Protect your starter fund: pause big non-essentials until you hit $1,000.

- Track wins: update a small progress bar monthly to stay motivated.

What Counts as an “Emergency”?

Clear rules reduce temptation. Emergencies include: job loss, medical/dental bills, essential car/home repairs, travel for a family emergency, or vet bills. Non-emergencies: vacations, upgrades, gifts, or routine bills you forgot to budget for. When in doubt, wait 24 hours, then decide.

If You Have Debt, What’s the Order?

Build the $500–$1,000 starter fund first to avoid new debt. Then tackle high-interest balances (e.g., credit cards) using Avalanche or Snowball. After the worst debt is gone, grow the fund toward 3–6 months. For detailed payoff tactics, see How to Pay Off Debt Faster.

Frequently Asked Questions

Where should I keep my emergency fund?

In a high-yield savings account or money market account—FDIC/NCUA insured, easy to access, and separate from your checking.

Is $1,000 really enough?

It’s a starter target that prevents many small emergencies from turning into credit card debt. Keep building toward 3–6 months of essentials.

Should I invest my emergency fund?

No. The goal is safety and liquidity. Investing adds risk and potential delays when you need the money most.

What if my income is irregular?

Save a higher multiple (6–12 months). Set percentage-based transfers (e.g., 10% of every payment) instead of fixed amounts.

Can I ever use it for opportunities?

Only if you maintain a minimum cushion (e.g., one month of essentials) and can replenish quickly—otherwise keep it for true emergencies.

Keep Momentum After You Hit the Goal

Once you reach your target, keep the account open and redirect your monthly transfer to the next priority: debt payoff, retirement contributions, or a “freedom fund” for career moves. Pair this with a skills plan from Top High-Income Skills to Learn and update your materials with a strong resume. If you’re still building a spending plan, start with How to Create a Budget That Actually Works.

Bottom Line

An emergency fund is a simple system: separate account, automatic transfers, and clear rules. Start small today. In a few months, you’ll feel the difference; in a year, you’ll have options. Learn more with our free resources and take your next step now.