Build Credit Responsibly From Scratch: The Complete Guide

You can build credit from scratch without stress or risky shortcuts. The key is a small set of habits—on-time payments, low utilization, and patience—plus the right starter tools like secured cards or credit-builder loans. This guide explains how credit scores work, which products to choose first, and how to design a 90-day plan that creates momentum you can measure.

How Credit Scores Work (and What Actually Moves Them)

Credit scoring models reward reliability and restraint. While algorithms vary, the most influential factors are consistent:

- Payment history (on-time vs. late) — the single biggest driver.

- Credit utilization — the percent of your limit you’re using; lower is better.

- Length of history — older, well-managed accounts signal stability.

- Mix of credit — both revolving (cards) and installment (loans) help.

- New credit — too many applications in a short period can hurt.

Your game plan is simple: never miss a payment, keep balances low, avoid unnecessary applications, and let time compound your profile.

Starter Tools: Choose One (Then Layer Carefully)

| Tool | How It Works | Best For | Watch Out For |

|---|---|---|---|

| Secured credit card | You pay a refundable deposit which becomes your limit; use and pay monthly. | True beginners or thin files | Annual fees; moving to unsecured card later |

| Credit-builder loan | Small “loan” held in a savings account you unlock after on-time payments. | Those who want installment credit in mix | Fees and interest; make sure it reports to all bureaus |

| Authorized user | A trusted person adds you to their long, well-managed card. | Very thin files, young adults | Only if the account has perfect history and low utilization |

Usage Rules That Build Credit Safely

- Autopay the statement minimum to avoid accidental late payments.

- Pay in full every month; avoid carrying interest.

- Keep utilization under 30% (ideally 10% or less). If your limit is $300, keep reported balance below ~$30.

- Use 1–2 small recurring charges (e.g., streaming) so activity is predictable.

- Add accounts slowly: one tool now, another in 3–6 months if needed.

30–60–90 Day Plan (From Zero to Momentum)

Days 1–30: Set Up and Stabilize

- Open a secured card or credit-builder loan (one is enough to start).

- Turn on autopay for at least the minimum; schedule a second payment to clear the full balance.

- Place two small subscriptions on the card so it’s used monthly.

- Track utilization weekly; pay mid-cycle if it creeps up.

Days 31–60: Optimize Reporting

- Pay your card before the statement closes (this lowers reported balance).

- Keep a simple log: statement date, payment date, balance, and score changes.

- Set alerts for due dates and when balance exceeds 20% of the limit.

Days 61–90: Add Mix and Build History

- Consider adding a credit-builder loan if you started with a card (or vice versa) to diversify mix.

- If a family member can help, discuss becoming an authorized user on a clean, older account.

- Resist new applications—let your current accounts age.

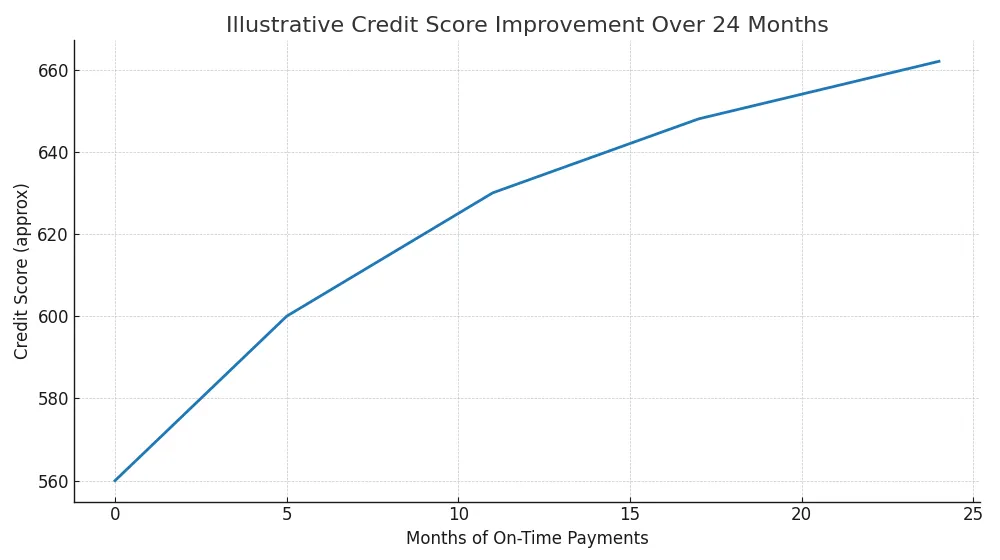

Illustration: A Gradual Credit Score Climb

How to Avoid Common Pitfalls

- Closing your oldest card: can shorten history—keep it open with tiny recurring charges.

- High utilization: even with on-time payments, maxed cards can drag scores down.

- Too many applications: hard inquiries and new accounts can dip scores temporarily.

- Missing a payment: set reminders, autopay, and a backup payment method.

When to Check Your Score (and What to Expect)

Check monthly via your bank or a reputable app. Expect small, steady increases; scores may move in steps as new statements report. Don’t obsess over daily changes—focus on the habits that drive long-term improvement.

Connecting Credit to Your Bigger Money Plan

A solid credit profile lowers borrowing costs and opens better opportunities. Pair this guide with a realistic budget, build a cushion using an emergency fund, and tackle high-interest balances with debt payoff strategies. As your finances stabilize, explore high-income skills to increase cash flow and accelerate goals.

FAQ: Building Credit From Scratch

How long does it take to build good credit?

With on-time payments and low utilization, many people see meaningful progress in 3–6 months, with stronger scores after 12–24 months as accounts age.

Is a secured card enough?

Yes, to start. One well-managed card can establish history. You can add a credit-builder loan later for mix.

Does checking my own score hurt it?

No. Personal score checks are soft inquiries and don’t affect your score.

Should I carry a small balance to build credit?

No. Carrying a balance only adds interest. Reporting a low balance is fine; paying in full is best.

What if I have no one to add me as an authorized user?

Skip that step. A secured card plus on-time payments still builds a strong profile over time.

Bottom Line

Credit building is a process you control: use simple starter tools, automate on-time payments, keep utilization low, and be patient. In a year, the difference will be obvious—in your score, your borrowing costs, and your financial confidence. Learn more with our free resources and take your next step today.