Retirement Planning Basics for Beginners: Start Smart and Stay the Course

Retirement planning can feel overwhelming, but it’s built on a few simple principles: start early, save consistently, invest in a diversified portfolio, and stay the course when markets get noisy. You don’t need complex strategies or perfect timing to build a secure future. You need a clear goal, a realistic savings rate, and a set of habits that compound over decades—just like an emergency fund or a well-structured budget creates stability today.

Step 1: Define Your Retirement Vision (and Ballpark Number)

Start with a simple question: What does retirement look like for you? Full stop at 65? A semi-retired phase where you consult part-time? Relocating to a lower-cost area? Your lifestyle choices drive your target number. A quick, practical estimate uses the “25x rule”: multiply your expected annual retirement spending by 25 to estimate the nest egg needed for a ~4% withdrawal rate.

- Example: If you plan to spend $45,000 per year, target ≈ $1.125M ($45,000 × 25).

- Adjustments: Include healthcare, housing changes, and taxes. If you’ll have a pension or rental income, reduce the target accordingly.

Step 2: Choose Your Accounts (Know the Tax Buckets)

Use a mix of accounts for tax efficiency and flexibility:

- Employer retirement plan (e.g., 401(k)): Often includes a match—this is free money. Contribute at least enough to get the full match.

- Traditional vs. Roth IRA/401(k): Traditional may reduce taxes now; Roth trades today’s deduction for tax-free withdrawals later. Many savers split contributions to diversify tax exposure.

- Taxable brokerage: Useful once tax-advantaged accounts are maxed; offers flexibility for early retirement or big goals before 59½.

If you’re self-employed, look at solo 401(k)s or SEP IRAs. Pair your contributions with income growth so you can raise savings over time.

Step 3: Decide on an Asset Allocation (The Mix That Fits You)

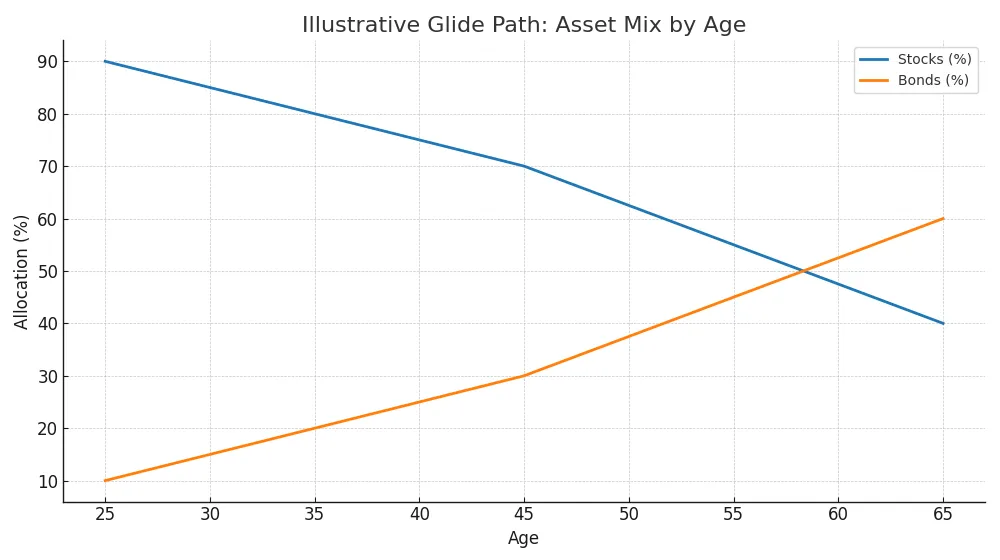

Your portfolio is simply stocks (growth) and bonds (stability), plus optional diversifiers. A common beginner approach is a global stock index fund plus a broad bond fund. Allocation depends on time horizon and risk tolerance:

- Long horizon, high tolerance: 80–90% stocks, 10–20% bonds.

- Mid-career: 60–80% stocks, 20–40% bonds.

- Near retirement: 40–60% stocks, 40–60% bonds.

Many investors use a “glide path” that gradually shifts toward bonds as they age. See the illustration below for a simple example.

Step 4: Pick Low-Cost Funds (Costs Compound Too)

Fees quietly erode returns. Favor low-cost index funds or ETFs for core holdings. Compare expense ratios; even a 1% difference compounds to a large gap over decades. If your plan offers a target-date fund with reasonable costs, it can be a simple one-fund solution that handles rebalancing automatically.

Step 5: Automate Contributions (Let the Calendar Do the Work)

Automation beats motivation. Set contributions to draft from each paycheck. Increase the rate 1–2% every year or after raises (see negotiation tips to boost income). If cash flow is tight, start small—consistency matters more than perfection.

Step 6: Rebalance and Review Annually

Markets move—your allocation drifts. Once a year, rebalance back to target by buying what’s underweight or selling a small portion of what’s overweight. In taxable accounts, prefer adding new contributions to the underweight asset to minimize taxes.

Step 7: Stay the Course (Behavior Beats Forecasts)

Market downturns are normal and unavoidable. Long-term investors are paid for withstanding volatility. Create written rules before the storm: your allocation bands, when you rebalance, and what you’ll do if the market drops 20–30%. Hint: keep contributing. Dollar-cost averaging during declines accelerates recovery.

How Much Should You Save? (Rules of Thumb)

Rules vary, but these benchmarks help:

- Save 10–15% of gross income toward retirement as a baseline; increase to 20% if you start late.

- By age 30: target ~1× your annual salary saved; by 40: ~3×; by 50: ~6×; by 60: ~8–10× (illustrative checkpoints).

- Maximize employer matches before anything else—it’s an instant return.

Common Pitfalls (and Simple Fixes)

- Waiting to start: Even small amounts invested early beat larger late contributions.

- Chasing hot funds: Stick with your allocation and rebalance; avoid performance chasing.

- High fees: Prefer index funds; review expense ratios yearly.

- Too much cash: Keep cash for emergencies (see emergency fund) but invest the rest according to plan.

- No written plan: Write a one-page IPS (Investment Policy Statement) with your targets and rules.

Sample One-Page Investment Policy Statement (IPS)

- Goal: Retire at 65 with $X enabling $Y/year.

- Allocation: 70% global stocks / 30% bonds; rebalance if any slice drifts by 5%+.

- Contributions: 12% of salary + employer match; increase 1% annually.

- Rules: No market timing; continue buying during drawdowns; review annually in January.

Coordinating Retirement With Your Money System

Retirement is part of a bigger plan. Build cash safety with an emergency fund, manage cash flow through a practical budget, and reduce drag from high-interest balances with a debt payoff plan. As your career grows, reinvest in high-income skills to raise your contribution rate and timeline options.

FAQ: Retirement Planning for Beginners

Should I prioritize retirement savings over paying off debt?

Get any employer match first, then focus on high-interest debt. After that, increase retirement contributions while finishing lower-interest balances.

Is a target-date fund good enough?

Often yes—if costs are low and the glide path fits your risk. It automates allocation and rebalancing so you can focus on contribution rate.

What if I’m starting late?

Increase savings rate, extend your timeline a bit, and reduce fees. A part-time “bridge career” can help. Consistency still wins.

Do I need a financial advisor?

Not always. Many beginners do well with simple, low-cost portfolios. If your situation is complex (stock options, multiple properties), consider a fiduciary advisor who charges transparent fees.

Bottom Line

Retirement planning rewards simplicity and consistency: automate contributions, choose a sensible allocation, and stick to written rules. Avoid the noise, keep fees low, and let time do the heavy lifting. Learn more with our free resources and take your next step today.