The Psychology of Spending: How to Stop Impulse Purchases

Impulse buying isn’t a character flaw—it’s how our brains are wired. Marketers know this, which is why checkout aisles, push notifications, and flash sales are designed to trigger fast, emotional decisions. The good news: you can flip the script. By understanding the psychology of spending—your triggers, environment, and habits—you can install simple guardrails that turn quick impulses into intentional choices aligned with your goals.

Why We Overspend: The Brain’s Shortcuts

Our brains use mental shortcuts to save energy. In money decisions, three forces do most of the damage:

- Dopamine loops: novelty and anticipation feel rewarding; clicking “Buy Now” becomes a habit loop.

- Present bias: we value immediate rewards more than future benefits (today’s package vs. next month’s savings).

- Decision fatigue: the more choices we face, the more we default to the easiest option—often spending.

To stop impulse spending, design a system that reduces triggers and increases friction between the urge and the purchase.

Know Your Triggers (Personal, Environmental, Digital)

Common triggers include: stress after work, scrolling late at night, “limited-time” promos, free shipping thresholds, and social comparison. Map your top three. Write them down. Then pair each with a counter-move:

| Trigger | Psychology | Counter-Move |

|---|---|---|

| Late-night scrolling | Lower willpower; novelty-seeking | Phone curfew, remove shopping apps from home screen |

| “Only 2 left!” countdowns | Scarcity bias | 48-hour rule + price tracker bookmark |

| Free shipping threshold | Loss aversion | Choose pickup or accept shipping; compare total cost |

| Deals via email/notifications | Cue-response loop | Unsubscribe; turn off push; use a shopping-only email |

Build Friction Between the Urge and the Buy

Impulse purchases thrive on speed. Slow things down:

- 48-hour rule: add to a “Maybe Later” list; if you still want it after two days, revisit.

- Delete stored cards: require manual entry; keep the card out of reach to add physical friction.

- Use cash for weak spots: groceries, dining out, or hobby categories become self-limiting with envelopes.

- One-tab shopping: no multiple stores open; finish comparisons in a notes doc first.

- Price-per-use test: estimate uses per year; if cost ÷ uses isn’t worth it, pass.

Flip the Dopamine: Make Saving Feel Rewarding

You can’t rely on willpower alone—replace the reward. Create visible progress and quick wins:

- Rename accounts to goals: “Japan Trip Fund,” “Emergency Safety Net” (see Emergency Fund Guide).

- Automate transfers the day after payday; treat savings as a bill.

- Gamify: streak counters, progress bars, or a monthly “no-spend challenge.”

- Celebrate under-budget months with a small planned treat—planned is the keyword.

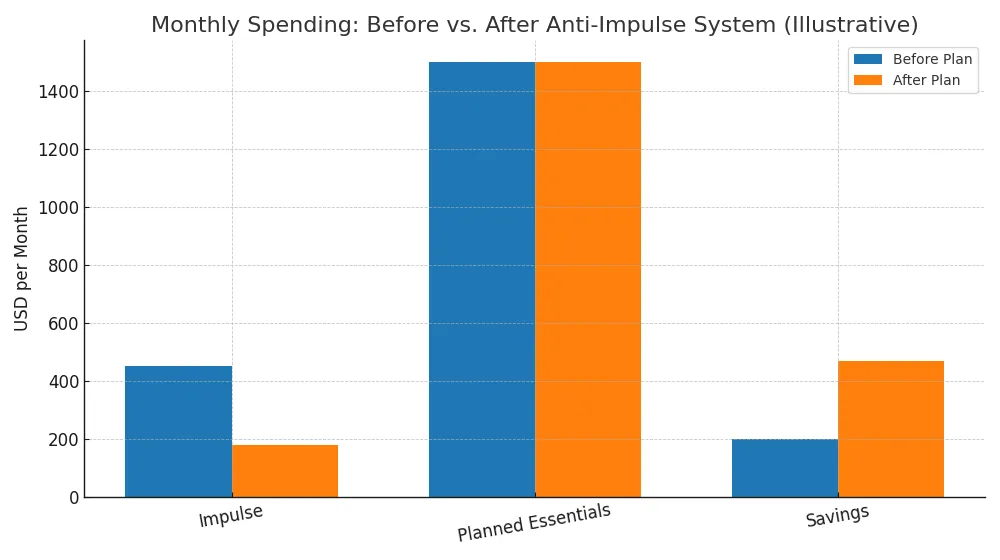

Monthly Spending: Before vs. After a Simple System

Design Your Anti-Impulse Shopping Workflow

Step 1 — One List to Rule Them All

Keep a single running list (notes app or spreadsheet). Every potential purchase goes there first with price, need/nice-to-have, and link. No buying until it’s on the list for 48 hours.

Step 2 — Compare by Outcome, Not Features

Write the outcome you want (“quieter apartment,” “healthier meals”). Compare options by how well they deliver the outcome per dollar—not by features the ad emphasizes.

Step 3 — Pre-Commit to a Budget

Use a category-based plan like the 50/30/20 budget: needs, wants, and savings/debt. Pre-commit to a fixed “fun” amount and enjoy spending it guilt-free.

Step 4 — Install a Cooling-Off Step

At checkout, pause. Ask: Is this the best version of the outcome I want? If not, save the cart and return after sleep.

What to Do After a Slip (Because It Happens)

Don’t cancel the whole plan over one impulse buy. Use a quick post-mortem: What triggered it? Which counter-move would have helped? Adjust your environment (unsubscribes, app blocks, card removal) and move on. The goal is trend, not perfection.

Advanced Tactics for Persistent Triggers

- Separate browsers: one for work/research, one for shopping; disable extensions on the shopping browser to reduce targeted nudges.

- “Hold” account: transfer the cost of returns or canceled orders into savings to reward restraint.

- Subscription audits: quarterly review; cancel, pause, or downgrade anything underused.

- Community accountability: share a goal with a friend; weekly 3-minute check-in on wins and blocks.

Connect Spending With Your Bigger Money Plan

Spending discipline frees up cash for what actually matters. Apply the savings to paying off debt faster, build your emergency fund, or invest for long-term goals (see retirement basics). If you want to grow income instead of shrinking joy, consider side hustles that pay or high-income skills.

FAQ: Stopping Impulse Purchases

Do I have to cut out all fun spending?

No. The goal is intentional spending. Keep a “fun” budget and enjoy it fully; remove the random buys that don’t add real value.

What if sales make me anxious about missing out?

Use a price tracker and the 48-hour rule. If the deal is real and right for you, it’ll come back—or you’ll find a better option with less pressure.

How do I handle social media shopping?

Unfollow the most tempting accounts, move shopping apps off your home screen, and only shop from your saved list—not from ads.

Can I still use credit cards?

Yes, if you pay in full and keep utilization low. If cards are a trigger, switch to cash or a debit-only plan while you reset habits.

Bottom Line

Impulse buying fades when you make good choices easy and bad choices hard. Identify your triggers, add friction, and replace the dopamine hit with visible progress toward goals. In a few weeks you’ll notice fewer “How did that get in my cart?” moments—and in a few months, you’ll see the difference in your savings account. Learn more with our free resources and take your next step today.